It appears as though variations have existed in the planet since its inception. Little has changed in the twenty-first century: inflation and economic problems are increasing, and it appears that everything is going wrong in the world. Naturally, you want to feel stable and assured about the future under such circumstances.

A lot of people are considering making investments, some of which involve buying diamonds. And that makes sense—the cost of these stones hasn’t decreased since they were first widely seen in public.

But investing in diamonds may be a complicated matter with a lot of potential hazards. To help you avoid pitfalls and approach diamond investing from a new perspective, we have put together this guide.

Why invest in diamonds?

Diamond is forever

The hardest material on Earth is undoubtedly a diamond. It took countless years to form, find its way, and finally come into your possession. It did not deteriorate throughout this period of time; in fact, it even grew more lovely and charming. A diamond is so strong that you don’t need to be concerned about anything ever occurring to it. The only possible outcomes are that it is stolen or that you misplace it. Though unpleasant in both cases, you can insure your diamond!

Diamond is wearable

A diamond is an investment that will provide you joy not only in its own right but also every day, when worn as jewelry, for example, because of its exquisite beauty.

Diamond is small and portable

It’s astounding that something so little can cost millions of dollars. The diamond is small enough to fit in the smallest safe or be carried around with ease.

Inflation proof

Inflation-driven increases in real estate, gold, silver, and diamonds are becoming increasingly more costly. Almost all physical commodities have this quality, which shields them from devaluation. So, there has never been a significant decline in the price of diamonds. These stunning stones kept growing even during the pandemic.

How to invest in diamonds?

Even while purchasing diamonds can seem quite alluring, it’s important to keep in mind that doing so is a complicated process with unique intricacies. Furthermore, this procedure carries a great deal of risk.

Find a professional advisor

Therefore, we advise that you get in touch with experts if you decide to give diamond investment a try. An expert diamond counselor is well-versed in the subtleties of diamond qualities, pricing, and attributes.

We also provide the option to choose diamonds for investment using our service. Without a doubt, our experts will assist you in getting started with diamond investing.

Learn the basics

It will be beneficial if you understand the fundamentals of the diamond industry even if you choose to choose an investment diamond with the assistance of a highly qualified specialist. You will be better equipped to negotiate the diamond market, comprehend how their price is set, and understand why certain gems are worth more than others.

You can begin by learning the fundamentals, such as what 4C is, which white diamond shade is thought to be the most expensive, and which fancy color diamonds are the rarest.

Diversify your diamonds

It is challenging to predict with precision when, how much, and which stone the price of diamonds will increase in the future. Don’t rely solely on one kind of diamond; instead, use all of your knowledge. Consider Blue or Pink as well, for instance, if you are dreaming of an Orange diamond.

Allocate your budget among various kinds of diamonds. Maybe one of them will be the only one to return all of your future investments, or maybe they will all be excellent investments.

Invest in rare yet desired stones

This is a very delicate and difficult topic; to succeed, you must possess the greatest flair or be an expert in the diamond industry.

The key is to select the ideal diamond for investment that won’t be very popular (there might be little demand for such a stone later) but also avoid taking a chance on an extremely uncommon or unpopular kind of stone (the same reason – there will be little demand for it later).

When we discuss the characteristics of an ideal diamond, we consider its color, weight, clarity, and cut. To put it plainly, a round diamond can be sold for more money than a marquis-cut diamond with the same qualities.

What are the risks of investing in diamonds?

Like any other investment, buying diamonds has certain risk, as we have stated time and time again. It is preferable to be aware of and ready for some dangers and challenges ahead of time.

Diamonds are a long-term investment

There’s always a waiting period when it comes to diamonds. The formation of these stones took place thousands of years ago underneath, and their price has been rising somewhat slowly. For example, you shouldn’t anticipate that the investment diamond you bought today will rise in value by thirty percent the following year. Although anything can happen, this will only occur as an exception. Have patience. By purchasing diamonds, you consent.

Opaque prices

The market for diamonds is not like the market for fruits or even stocks. Many elements play a role in pricing. Furthermore, supply and demand determine all prices in the diamond market; there is no set pricing structure. The only way to determine whether or not you are overpaying for a stone is to compare it to comparable stones offered by other vendors or dealers. But even in this situation, it will undoubtedly be challenging to grasp something clearly.

The majority of diamond dealers utilize the Rapaport price list, however even this list isn’t exhaustive. The list, which serves as a standard, only considers the fundamental elements of color, clarity, and carat weight. The market ultimately decides on the price.

Difficulties with tradability

Purchasing a diamond can occasionally be simpler than selling one. Keep in mind that purchasing an investment diamond will require hard work in the end.

If you’re selling a diamond to another shop, you’ll need to outshine them in terms of persuasiveness to persuade them that the asking price is reasonable. Auction houses are an additional option for selling investment gems. But they only display really special stones, and they also take a cut.

Which diamonds are the best for the investment?

Large, flawless, colorless or fancy color diamonds are rare in the world – therefore, most of them are considered an investment. The best investment stones are also defined by the famous 4Cs: color, carat weight, cut and clarity.

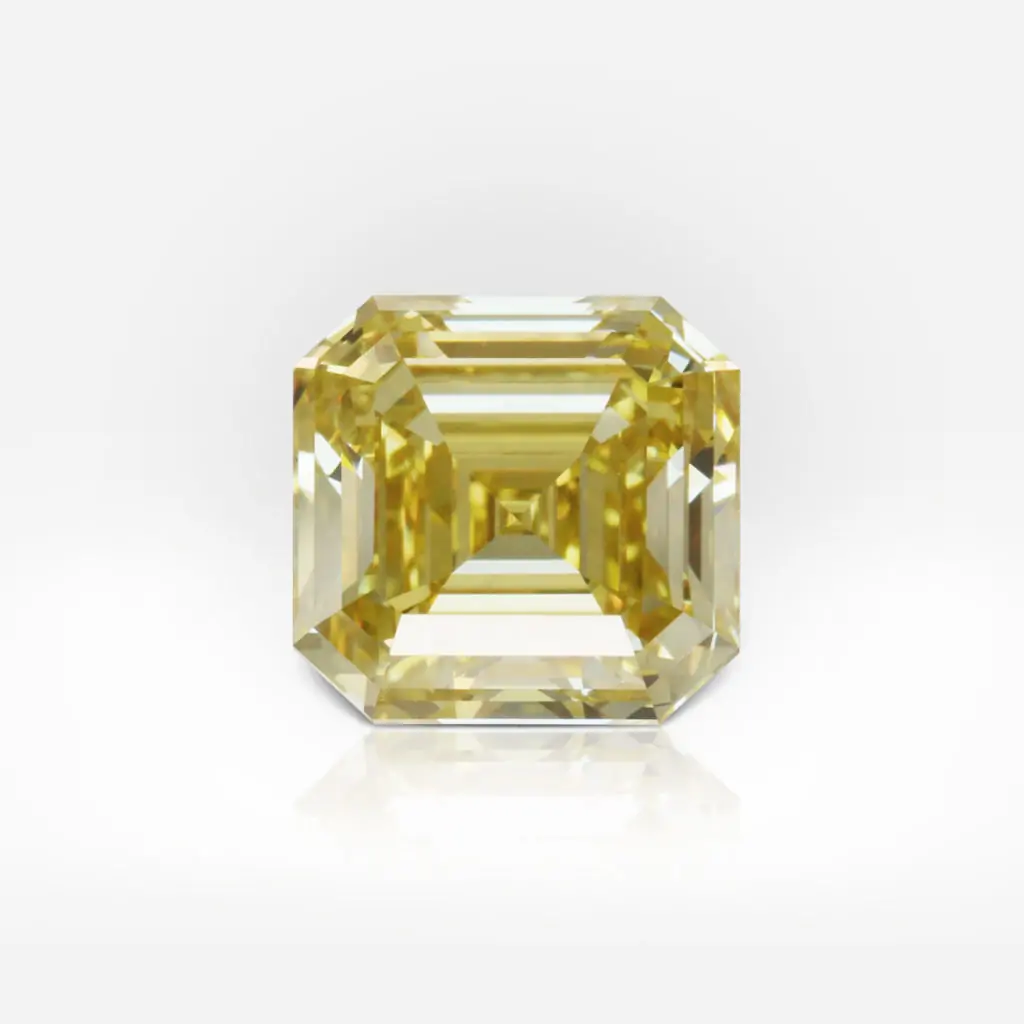

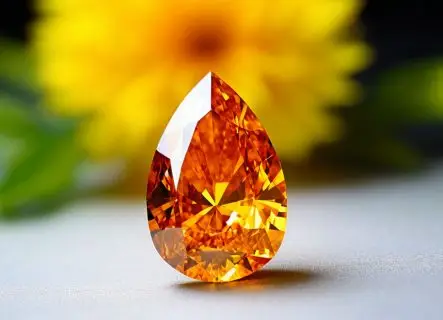

Color

When it comes to investing, white colorless diamonds are the most preferred choice. Their color grade is assigned a number between D and Z, where Z denotes the existence of color and D indicates complete transparency. The stones from D to H are investment stones.

Diamonds with fancy colors are far more rare. Their value increases with increasing color intensity. Select the ones with color grades of Fancy Deep, Fancy Vivid, and Fancy Intense. Recall that the rarest diamonds are thought to be red, blue, and pink.

Carat weight

The larger the weight, the more expensive the stone (in case it has other characteristics of the highest grade).

Cut

A diamond’s internal fire and glitter depend on its cut. When searching for stones to invest in, focus on those with an Excellent rating.

Clarity

Flaws and imperfections affect a diamond’s value significantly. The clarity of investment stones must be Flawless or Internally Flawless.

Diamond investment conclusion

Like any investment, buying diamonds has its advantages and disadvantages. Of course, there are instances when the desire to buy a stunning stone that sparkles and may increase in value overcomes the fear of making a bad investment decision. Ultimately, the only way to win big is to take chances.

If you do choose to invest in diamonds, though, speak with experts rather than depending solely on chance. Remember to educate yourself about the world of diamonds in order to decide what to invest in. Purchase certified and top-quality diamonds. Of course, don’t forget to listen to your heart.